Supporting owner-occupied homeowners with hardships.

Our Mission

The mission of the NTLA Foundation is to support owner-occupied homeowners with hardships.

The purpose of the NTLA Foundation is to provide property preservation solutions to troubled homeowners and a resource for local governments and members of the National Tax Lien Association.

Help Build the Foundation

The NTLA Foundation’s mission is to provide economic relief to Americans with demonstrated hardship and in danger of losing their homes to property tax foreclosure. These individuals and families include, but are not limited to, the elderly, disabled war veterans, active U.S. military personnel, and many others. Donors of the NTLA Foundation will represent a philanthropic body responsible for saving these Americans’ homes.

To establish an evergreen source of funding, the NTLA Foundation needs organizations, and individuals with a capacity and an inclination to give to donate funds.

Who do we help?

We work with the elderly, disabled veterans, active military personnel and other hardship cases who owe back taxes to avoid property tax foreclosures for owner occupants.

The home must be in your name and your full-time residence. In order to qualify, you must be facing immediate risk of foreclosure due to non-payment of property taxes.

EVANSVILLE, IN, October 8, 2024 — The NTLA Foundation, dedicated to preserving homeownership for those facing financial hardship, has successfully intervened to halt the property tax foreclosure of Thomas Pryor, a disabled veteran and long-time homeowner. This critical action, taken just 24 hours before Pryor faced eviction, underscores the Foundation’s mission as a last-resort safety net for homeowners in crisis. Pryor, who has owned his home for 40 years, was reeling from the recent loss of his wife. Without immediate assistance, he was on the verge of losing the only home he has known. Thanks to the timely support from the NTLA Foundation, Pryor can now remain in his home and has filed for a homestead exemption to prevent future tax issues. Read full story

Brad Westover, NTLA Executive Director, Becky Sherrill, Homeowner, Will Roberts, Volusia County Tax Collector

DELAND, FLORIDA, May 2, 2024 — From the brink of homelessness to saving her home, Ms. Becky Sherrill of DeLand, Florida was able to halt tax foreclosure because of the generosity of the NTLA Foundation. The NTLA Foundation swooped in and paid off Ms. Sherrill’s outstanding property tax obligations thereby removing the pressure and anxiety of losing her family home. Read full story

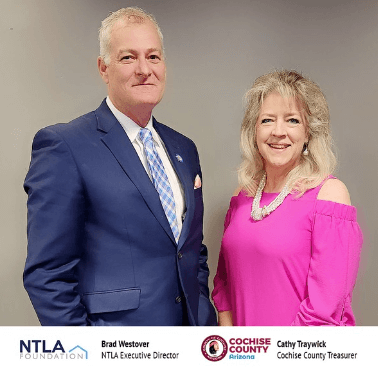

SIERRA VISTA, ARIZONA, March 24, 2023 — NTLA Executive Director Brad Westover today announced a disabled Cochise County couple facing property tax foreclosure will retain ownership of their home thanks to a donation from the National Tax Lien Association (NTLA) Foundation. On March 24 Cochise County Treasurer Cathy Traywick accepted the donation on behalf of the couple and applied it to their outstanding tax obligation. The Sierra Vista couple was experiencing extreme financial hardship when they failed to pay their 2018 property tax bill. Following state statute, Cochise County sold the property tax obligation in its annual tax certificate sale. Guardian Tax Partners, a tax lien investing company headquartered in Omaha, Nebraska, purchased the tax certificate and proceeded with the collection. “When tax lien investors purchase tax certificates to earn a reasonable return on investment, they help districts stabilize their tax collections,” said Traywick. “They also help property owners retain ownership of their homes. I see this as an oddly beautiful dichotomy.” Read full story

Request Assistance

Complete the application to request assistance.

Who can apply for assistance?

Owner-occupants, local governments and members of the National Tax Lien Association are allowed to submit one (1) application per year for consideration.

Who evaluates the application?

The NTLA Foundation’s Board of Directors ultimately decides who receives assistance. The NTLA Foundation committee determines the scope of assistance.

The Process

If you are facing immediate risk of property tax foreclosure, or a member of the National Tax Lien Association (NTLA) who would like to request assistance for someone at risk, please complete this application.

It is vital to provide the NTLA Foundation with a complete and accurate description of the circumstances to explain why this hardship situation merits relief.

- What caused you/the tax payer to be in this situation

- Documentation required:

- Medical disability:

Medical bill(s), insurance claim, death certificate

Natural or accidental disaster:

Police/fire report, insurance claim

Extraordinary expenses:

Car repair bill, appliance replacement bill, air conditioner or heat replacement bill

Unemployment:

Termination letter on letterhead, unemployment agency registration

- Medical disability:

Be sure to include the specific type and amount of assistance you are requesting and supporting documentation.

- What type of assistance are you requesting?

- Property Tax (Interest only)

- Property Preservation Relief

- Code Violation Relief

- Property Tax (Principal only)

- Property Tax (Principal plus Interest)

- Amount

- Documentation:

- Tax bill(s)

- Notice from tax lien servicer

- Notice of tax sale

- Notice of foreclosure

Your application will be reviewed initially by a NTLA staff member who will share the information with the NTLA Executive Director. At that time, the property at risk will be researched and contact will be made to the county/municipality Tax Collector or Treasurer to determine the status. If the information validated looks to meet the criteria set forth by the NTLA Foundation, the assistance request will be presented to the NTLA Foundation committee to determine the scope of assistance to be awarded.

If your case is approved for donation funds, those funds will go directly to the entity to correct the hardship situation.

Here to Help

The National Tax Lien Association believes in home ownership in America. This resource center is built to help struggling homeowners with the ability to retain ownership through national and local assistance programs.

Help Homeowners in Need

The mission of the NTLA Foundation is to offer financial assistance to Americans facing significant hardship and at risk of losing their homes due to property tax foreclosure. This includes, but is not limited to, elderly individuals, disabled veterans, active U.S. military personnel, and many others in need. By contributing to the NTLA Foundation, donors become part of a philanthropic effort dedicated to saving these homes and providing crucial support.

Donate funds today to help establish an evergreen source of funding.